The housing recession doesn’t exist and will never exist.

Why?

It’s an invented term by different media outlets.

What can exist is a housing market downturn and/or a recession.

Keep focusing on real estate seller lead generation during a recession or a housing market downturn. You will be in for a surprise.

To prevent this, I wrote this article discussing how you can adapt your real estate lead generation strategy to a recession or a housing market downturn.

Then, sellers will be abundant, but buyer prospects will be scarce.

So, in today’s article, I cover…

- What a recession is and why something like a “housing recession” doesn’t exist.

- What a real estate or housing market downturn is.

- What current real estate situation we are in, and whether there is a (real estate) recession or housing market downturn on the horizon.

- What happens during a recession to the real estate market.

- The home buyer and seller dynamic during a recession (Sellers’ vs. Buyers’ Market).

- 13 recession-proof real estate niches for lead generation.

- How to create a recession-proof real estate lead generation strategy.

What Is a Recession, and Does Something Like a “Housing Recession” Even Exist?

So that we are on the same page, let’s first get the definition of a recession out of the way.

Investopedia states, “A recession is a significant, widespread, and prolonged downturn in economic activity.

A popular rule of thumb is that two consecutive quarters of decline in gross domestic product constitute a recession. Recessions typically produce declines in economic output, consumer demand, and employment.“

And according to Wikipedia, “…a recession is a business cycle contraction when there is a general decline in economic activity.

Recessions generally occur when there is a widespread drop in spending (an adverse demand shock).

This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

A recession is less severe and prolonged than a depression.“

Now let’s get to the term “Housing Recession.”

I consider it a newly introduced term by different media outlets.

Since a recession, by its very definition, is a “general decline in economic activity,” a housing recession can’t exist.

An isolated element of the whole economy can’t have a recession.

It involves either the majority or all industries or none.

The housing market can have a “crisis” or a “downturn,” and I prefer the last term.

Still, a significant downturn, crisis, or bubble burst can lead to a recession, as in 2008 with the housing crisis.

So What Is a Real Estate or Housing Market Downturn?

When writing or proclaiming a “housing recession” is on the horizon, some media outlets mean a real estate downturn.

Before we examine whether a recession and a housing market downturn are on the horizon, let’s look at what the latter means.

The term “downturn” is borrowed from the world of financial market trading.

It refers to the market prices and means that the prices turn from rising to dropping, which happens when the demand declines.

The same is true for the real estate market.

So, a housing market downturn is when housing prices stop rising and start dropping because of a decreased buyer demand and an increased property supply.

Cutting through the mass media noise and focusing more on facts, how can we find out where we are (September 2022)?

Let’s analyze this in the next section to start getting an overview and helping create the real estate lead generation blueprint for a recession and a housing market downturn.

What Is The Current Real Estate Market Situation? Is a Recession or Housing Market Downturn on the Horizon?

Several indicators can help determine the current state of the economy (recession or no recession) and the current real estate market situation.

The following indicators can show you a recession is in the makings:

- A decline in real GDP

- A decrease in real income

- Decline in employment

- A reduction in industrial production

- A drop in wholesale/retail sales

Then, there are seven housing indicators you want to watch and analyze before concluding about the current real estate market situation.

They also help to estimate a future trend.

So, which indicators do I mean?

They are as follows:

- The housing affordability index (should go up)

- Interest rates (should go up)

- Median days on the market (DOM) (should increase)

- The housing inventory (should increase)

- The home builders’ sentiment index from the National Association of Home

- Builders (NAHB) (should decrease)

The housing affordability index can show how well a family can qualify for a mortgage on a median-priced home. It refers to national and regional levels.

A value of 100 implies a family with a median income has enough monetary means to qualify for a mortgage on a median-priced home.

The higher it is, the better a family can qualify for a mortgage.

What would we have to look for to confirm a potential housing downturn?

Exactly, an increasing housing affordability index compared to previous months.

Why?

Because decreasing prices will lead to more families being able to qualify for a mortgage, thus increasing the housing affordability index.

The interest rates refer to what the family would pay for their mortgage or loan over time.

Changing interest rates can have many different effects on the economy.

For example, increased interest rates usually decrease demand since borrowing money gets more expensive and vice versa.

Since, in a housing downturn, the buyer demand goes down (remember, decreasing housing prices), we would need to look for increasing interest rates fueling a demand decrease.

Median days on the market (DOM) are the number of days a house needs until it gets sold. This is the period between a property being listed for the first time and signing a sales contract.

We know a housing downturn comes with a decreased or decreasing buyer demand leading to houses sitting longer on the market.

So, we have to look for a trend toward an increased value of the median days on the market.

The housing inventory is the next indicator and shows the number of homes listed for sale.

As you may already imagine, the inventory will increase in a housing downturn with reduced buyer demand.

Why?

For one, overly-greedy sellers who considered selling during a sellers’ market waited too long to get into the market for the right price.

Now, they enter the market, but a bit too late.

A second primary factor on the sellers’ side is, of course, mortgage interest rates.

If they increase, more sellers may want to enter the market.

So, we want to look for an increasing housing inventory signaling a housing market downturn.

The last one we can look at is the home builders’ sentiment index.

It’s a sentiment survey carried out monthly.

It measures how home builders feel about the current sales of single-family homes.

An index above 50 indicates a favorable market outlook for the industry.

So, when we want to find a housing downturn with decreased demand, we must look for an index below 50.

Next, I checked all the above indicators and put them in the overview table below.

To find a trend, I compared the current numbers with previous years.

This is to find a long-term trend to avoid “noise” and fallacious interpretations due to seasonality.

Mass media outlets are much better than me at fallacious interpretations of market noise.

| Recession Indicator | Status | Housing Downturn Indicator | Status |

|---|---|---|---|

| A decline in real GDP ? | ✔ | An increasing housing affordability index ? | ❌ |

| Decline in real income ? | ❌ | Increasing interest rates ? | ✔ |

| Decline in employment ? | ❌ | Increasing median days on market (DOM) ? | ❌ |

| Decline in industrial production ? | ❌ | An increasing housing inventory ? | ❌ |

| Decline in wholesale/ retail sales ? | ❌ | A decreasing home builders sentiment index ? | ✔ |

These are the sources I checked for the above table:

- bea.gov/data/gdp/gross-domestic-product

- ceicdata.com/en/indicator/united-states/monthly-earnings

- tradingeconomics.com/united-states/employment-rate

- ycharts.com/indicators/industrial_production_index

- tradingeconomics.com/united-states/retail-sales

- tradingeconomics.com/united-states/wholesale-inventories

- ycharts.com/indicators/reports/monthly_housing_affordability_index

- tradingeconomics.com/united-states/interest-rate

- fred.stlouisfed.org/series/MEDDAYONMARUS

- fred.stlouisfed.org/series/ACTLISCOUUS

- tradingeconomics.com/united-states/nahb-housing-market-index

Is a (Real Estate) Recession Coming – How to Know the Signs?

As you can see from the above table, only one of the five indicators points in the direction of a recession, and only two point in the direction of a housing downturn.

If I had to pick only one indicator for finding a housing market downturn, it would be the housing inventory.

Why?

Because it can unmistakably show the effects of a downturn. Most other indicators show you only the factors that can cause the inventory to change.

The best indicator for a potential future housing market trend is interest rates.

And the only sign I can see that a housing market downturn may occur in the not-so-distant future is the increase in interest rates.

The effects of an increased inventory and a decreased buyer demand usually come with a delay of a few months.

Regarding the signs of a recession, I would closely monitor the relevant indicators I used in the above table, especially unemployment and real income.

At the moment, I don’t see a clear sign of a recession in the strict sense of the word.

What Happens to the Real Estate Market During a Recession (Is Real Estate Affected)?

Although there is no recession or housing market downturn just yet, it’s never a bad idea to be prepared.

And that’s the idea of this article. To help you prepare for that with your real estate lead generation strategy and methods.

So, what happens to the real estate market during a recession, and how is real estate affected?

From the above, we learned that we have to deal with a decline in real income, employment, industrial production, and wholesale/retail sales during a recession.

What effects does a decline in real income and employment have?

An increasing number of people can no longer afford their current housing (as owners or tenants).

They will have to sell, downsize and live in smaller rental properties.

In the worst cases, some people end up on the street and on food stamps.

In a smaller segment of the real estate market, this may increase the demand for smaller (rental) units.

Houses will be more challenging to sell and stay on the market longer.

Also, more and more houses on the market will actually be “underwater” (the home loan has a higher principle than the home is worth).

The overall housing inventory increases, including the supply of houses in pre- and foreclosure.

This will lead to house prices going down.

Due to the increased supply and reduced house prices, homebuilders will also have less demand.

Potential home builders’ clients may wonder: “Why build something new when there are so many more affordable houses on the market that I can have right now?!“

Homebuilders may also be under price pressure (more competition).

Potential buyers will compare the costs of building a new home with the purchase of an existing home where prices are falling.

This may also fuel unemployment since construction companies need to shrink to survive.

What about the decline in industrial production and wholesale/retail sales?

It will mainly affect the commercial real estate market.

Due to the decline in wholesale and retail sales, more businesses will go belly up.

This will lead to more vacant commercial retail (e.g., in malls), industrial (e.g., warehouses), and office space properties.

It will increase the supply of available commercial properties for rent leading to a reduction in rents and a decreased ROI for commercial property owners/investors.

The decreased ROI will make more commercial property owners/investors want to sell, so the inventory of available commercial properties will also increase, thus reducing the purchase prices.

Additionally, a decline in industrial production also leads to more unemployed people, thus leading to the unemployment effects on real estate I already covered above.

The Home Buyer and Seller Dynamic During a Recession (Sellers’ vs. Buyers’ Market)

Finally, we can get closer to real estate lead-generation strategies during a recession.

So, as the next piece of information, we need to understand the home buyer and seller dynamic.

Right now, there is still a sellers’ market.

Because of a low inventory, buyers compete with each other more.

Sellers know that and milk the situation.

The market perceives their house as a precious good, and they have better chances of selling at the best possible price.

So, sellers can be picky regarding the buyers and have the upper hand in negotiations.

This situation takes a complete U-turn when a buyers’ market during a recession occurs.

You will find that sellers will be much more often motivated to sell.

You may not even have to do much seller lead generation because you can pick up listings like mature, low-hanging apples on a tree.

Sellers may think, “Wow, ten showings only yesterday and today, I am exhausted….“

Not so in a buyers’ market.

In that case, the thoughts may be, “I am so glad my realtor finally brought me a buyer for a showing after eight weeks.

I thought there would never be a showing of my house.

Maybe I should drop the price further? The neighbors that are also selling already had a showing after five weeks…“

Since there will be fewer cash buyers, the ones who are, have the upper hand and know that.

So, while in the current sellers’ market, your focus is likely on seller lead generation, in a recession, it is and should usually be on buyer lead generation.

Before we get to the different buyer lead generation methods, you may want to…

Consider Also Changing or Focusing on These 13 Recession-Proof Real Estate Niches for Lead Generation

I discussed the benefits of focusing on a real estate niche in this article.

It is usually a sound game plan to efficiently use your available resources, even without a recession.

Owners/tenants, business owners having to downsize, and all the different reasons and consequences significantly inform which real estate niche will likely benefit from a recession.

They will have to look for more economical and smaller options on the market.

These are smaller homes or apartments in the case of (former) homeowners and tenants.

In the case of business owners, these are smaller commercial properties.

From my longer article about real estate niches, I identified the niches likely benefitting or at least being recession-proof:

- Mobile homes

- Mobile home parks

- Tiny houses

- Self-storage units

- (Smaller) residential homes/ units

- Senior housing (seniors still need to downsize recession or no recession) (source)

- Small and large apartment buildings

- Coworking/shared office spaces

- Overseas retirement (for geo-arbitrage reasons)

- Apartments/townhouses in school district neighborhoods

- Rent to own and seller financing

- Short Sales/Preforeclosures

- Foreclosures

How to Create a Recession-Proof Real Estate Lead Generation Strategy

At the time of this writing (September 2022), it may still be hard to imagine that in the future, you may have to work as hard to generate buyer leads as you now do for seller leads.

This may be especially true for real estate professionals who haven’t experienced a buyers’ market.

Creating a recession-proof real estate lead generation strategy means knowing how to generate buyer leads because those will be more valuable leads than seller leads.

There is no one best lead generation strategy for buyer leads. Why?

Because it depends on so many different factors and questions you have to ask yourself first, such as:

- What is your annual gross commission income goal?

- When would you like to reach it?

There is a significant difference in how you approach your lead generation when you, for instance, want to double your annual gross commission within one year versus reaching this goal in three or more years.

As a general rule: The faster you want to reach a sporty goal, the more skills and leverage (financial, other people’s time and/or skills, traffic, platforms with traffic, etc.) you will need.

Based on the answers to the first two questions, what level of problem and need awareness do the target prospects need to have? (e.g., “I haven’t thought of buying yet.” Vs. “I need to buy a property within the next week to allocate my cash that loses value due to inflation.”)

You may also want to read my article about the different types of real estate leads in this context.

Depending on when your income goal needs to be reached, you want to focus on need and problem-unaware or aware prospects.

Usually, the more problem- and need-aware the prospects are, the higher the cost per lead.

Based on the answers to the previous questions, what real estate lead generation methods are the most suitable to focus on?

Also, in my article “The 5 Types of Real Estate Leads and the One Mistake Most Make”, I mentioned generally available real estate lead generation methods.

The same ones can be used to generate buyer leads in a recession.

To recap shortly, the main categories of lead generation methods there are the following:

- Paid and unpaid outbound real estate marketing/lead generation (e.g., cold calling, PPC ads on Google search)

- Paid and unpaid inbound real estate marketing/lead generation (e.g., publishing videos on YouTube, content marketing via blog posts)

- Real estate referral marketing (e.g., partnering with financial advisors or investors)

- Database marketing (e.g., past client direct mailing)

The whole collection of more detailed methods within these categories is found in this article.

When you read my article “How to Generate Real Estate Seller Leads Without Begging,” you may find that the same article can also be used to work out a buyer lead generation strategy.

In the same article, I mentioned the following rule of thumb:

“The more focused you can get with your lead generation method (outbound or inbound) targeting sellers or buyers aware of solutions for their problems and needs, the higher the chances they will be warm.”

So, generating buyer leads via PPC search ads (e.g., Google) will lead to better quality leads than PPC ads on social media (e.g., Facebook).

Why?

Somebody lost in their Facebook feed scrolling may or may not be aware of having a problem or need regarding buying a house when he sees your ad coming out of nowhere.

In contrast, a buyer prospect looking for a solution to their problem on Google is already aware and thus warmer.

It follows logically.

Now, it may become more apparent why I also mentioned different recession-proof real estate niches you may want to focus on above.

You can better learn about the individual buyer prospect and thus work out their customer journey.

The latter helps you determine the stages of the problem and need awareness and which lead-generation methods are used.

It will then improve the way you target them and the real estate sales copy you use in your advertising messaging.

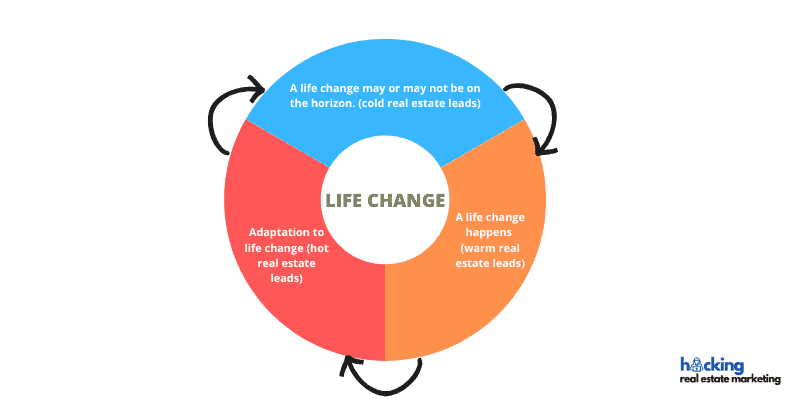

As I did in my article about the 5 Types of real estate leads, I attach the same infographic below showing the “evergreen real estate lead type cycle.”

It also applies to real estate buyers and can inspire you to find additional ideas for real estate customer journeys (in our case, for buyer prospects during a recession).

All revolves around life changes (e.g., divorce, birth, success, cash that needs to be invested, etc.) regardless of recessions, and it’s also valid for buyer leads.

This article has been reviewed by our editorial team. It has been approved for publication in accordance with our editorial policy.

- Why Real Estate Conversion Rates Are 6-Times Below Average - March 21, 2024

- How to Manage Your Apartment Advertising Campaign - February 23, 2024

- Finding Marketing Channels for Apartment Advertising - February 12, 2024